It is difficult to succeed in business. The more tools you have to help you succeed, the better your chances are of success. A great tool to help you with your accounting needs is Intuit’s QuickBooks Online.

I wrote about the many reasons businesses fail; poor accounting practices is one of the top reasons. You are not in control of your business unless you have your books under control. If you don’t understand your numbers, you are going to make decisions based on false information.

It is important to use a tool such as QuickBooks Online to help you with your budget planning. Your budget process encompasses all of the financial needs of your business. Businesses that fail to establish a proper accounting system put themselves at risk of failing.

As entrepreneurs, we are pulled in many different directions. QuickBooks Online helps you stay organized by helping you organize everything in one place.

I found the QuickBooks Online easy to set up. Once I signed up, I had to answer a few questions:

- What’s your business called?

- How long have you been in business?

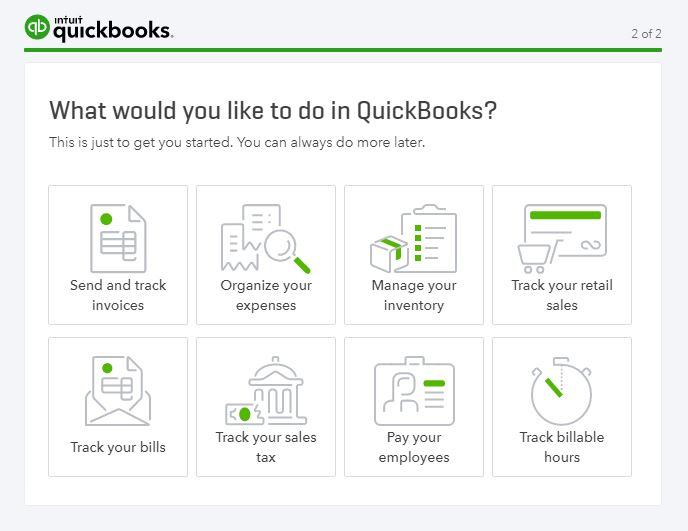

There was even an option to bring your data if you have been a QuickBooks Desktop version. I also like the option to select right off the bat what I wanted to do with QuickBooks Online (see image below).

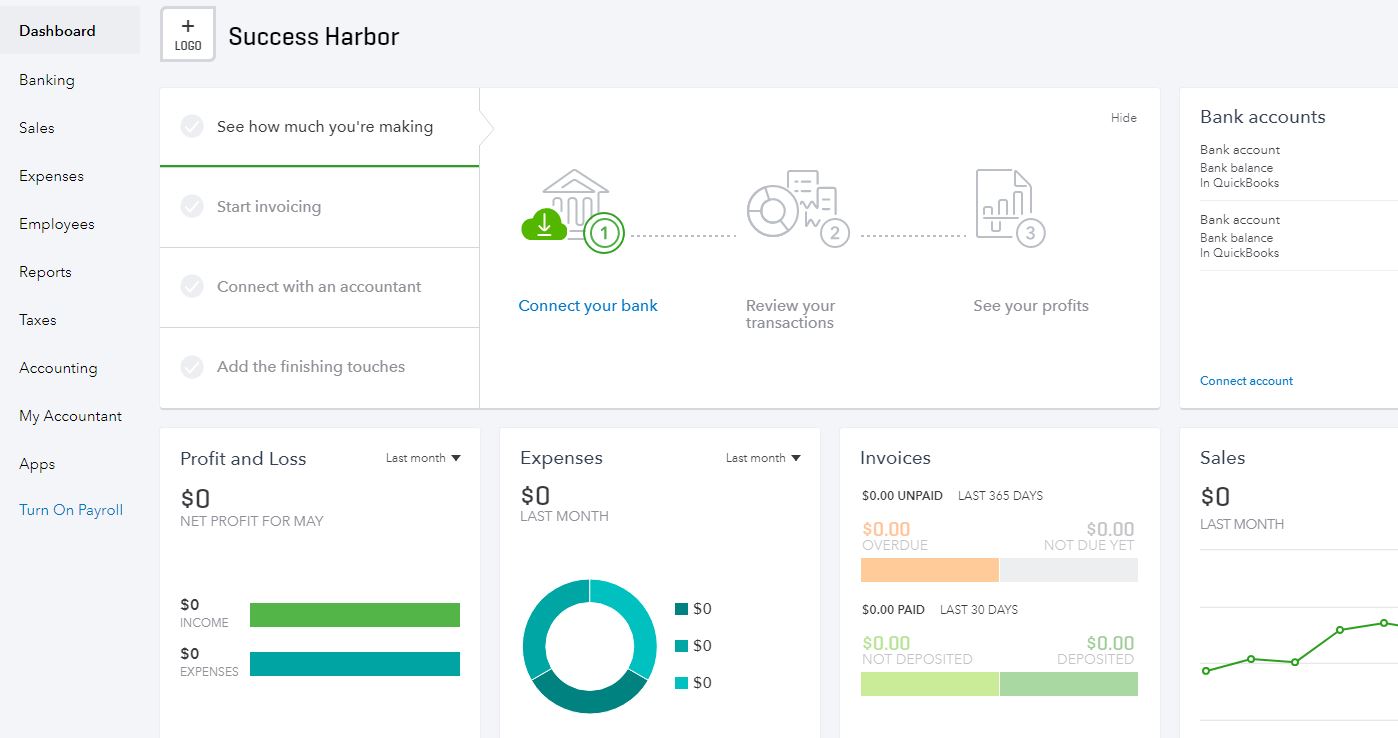

After I set up my trial account, I got access to my dashboard. See screenshot below:

I found the QuickBooks Online dashboard very user-friendly. In one central location, you get access to your:

- Profit and Loss

- Expenses

- Invoices

- Sales

- Bank accounts

I also liked the “invoicing feature.” I think consultants, freelancers, and professional service providers would really appreciate this feature.

You can simplify your accounting three ways, using QuickBooks Online.

#1. I know I could improve my cash flow by using the QuickBooks Online invoicing feature. QuickBooks Online also helps you get paid faster.

With QuickBooks Online, you can:

- Send invoices to enable your customers to pay you with credit/debit cards.

- Take payments through bank transfers.

- Automate payment notifications to nudge your slow-to-pay customers.

#2. Are you having a hard time tracking how much money you spend in your business? I found the reporting feature great because I always want to know my income and expenses. QuickBooks Online can quickly generate and up-to-date “Profit and Loss” report for your business too.

QuickBooks Online helps you keep track of money in multiple ways:

- Record purchases, bills, and other expenses in one central location.

- QuickBooks Online will help you to categorize financial transactions quickly.

- You can easily run reports such as profit and loss.

I like how QuickBooks Online connects with many different apps such as PayPal. Sometimes my clients pay me through PayPal, and I am glad that QuickBooks Online has a “Sync with PayPal” feature.

#3. Do you want to get a quick snapshot of how much money you are making? Use any of the following QuickBooks Online features:

- Review and categorize deposits and expenses.

- Automatic bank transaction downloads.

- Categorize previously recorded transactions.

Another very important feature of QuickBooks Online has to do with cloud computing. When using QuickBooks Online, you don’t have to worry about backing up your financials. It is done for you in the cloud. Your data is always available and always safe and secure.

If you are concerned about having the right hardware to use QuickBooks Online, consider this. QuickBooks Online is compatible with:

- Personal computers

- Apple/Mac computers

- Tablets

- Smartphones

Without a solid accounting system, even profitable businesses can fail. You might think you are running a profitable business because you don’t have an accurate read on your financials. Poor accounting practices give entrepreneurs a false sense of security that can lead to unfixable problems. This is a great time to take advantage of QuickBooks Online 30-day trial. You can also save up to 70% around Independence Day.

Using QuickBooks Online, you can decrease the chances of mismanaging your financial position and help you catch financial problems before they can damage your business.