The following is a sponsored post for UnitedHealthcare. All thoughts and opinions are my own.

In one of my previous posts, I have shared how UnitedHealthcare simplified the healthcare insurance shopping experience. Deciding on what health insurance to offer to your employees seems like a time-consuming process. But, it doesn’t have to be that way if you are using the right tools. UnitedHealthcare offers small businesses a quick way to select health insurance for their employees.

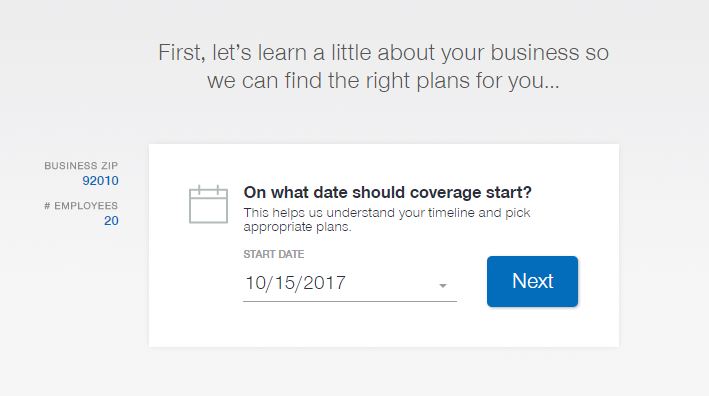

I wanted to test the process on the UnitedHealthcare website. After I have entered my zip code, the number of employees in the company, and the start date the coverage should start, I was ready to view my insurance options. I like the simple interface. It is not an overwhelming process.

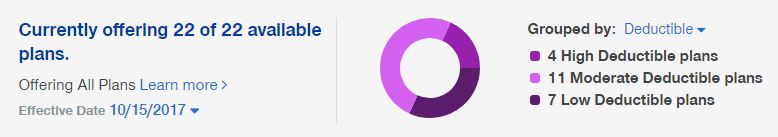

On the next screen, there were 22 available insurance plan options for me to choose from. I was happy to see so many options. You might not need all of the 22 options, but UnitedHealthcare recommends that you at least offer 6 plans to your employees. If you offer 6 or more plans your employees will be able to use the Employee Fit Finder tools. The Employee Fit Finder is an interactive tool to help your employees narrow down their plan by asking them questions about their lifestyle and family.

My insurance options were grouped by deductible.

Of the 22 plans there were:

- 4 High Deductible plans

- 11 Moderate Deductible plans

- 7 Low Deductible plans

I recommend that you offer at least two of each deductible levels, 2 high, 2, moderate and 2 low. It is important that your employees feel that they have options.

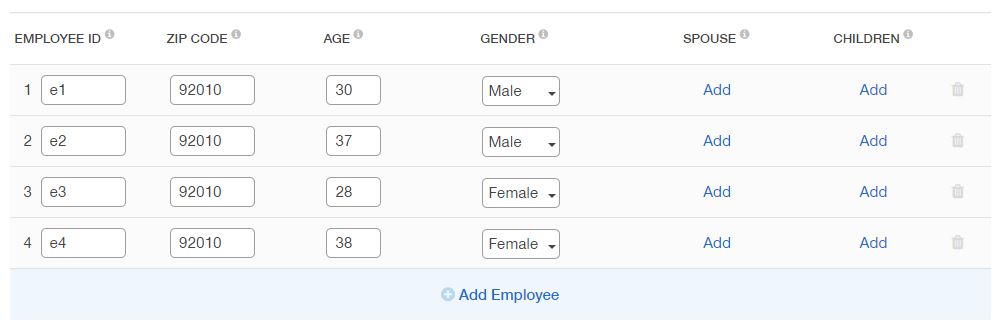

Next, I had to enter the employee details such as Employee ID, Zip Code, Age, Gender and information on spouse and children.

Once you have entered the employee information, your pricing in updated. At this point you can:

- Review, edit and share your quote.

- Access saved information on an encrypted UnitedHealthcare web page.

- Get support, quickly and easily.

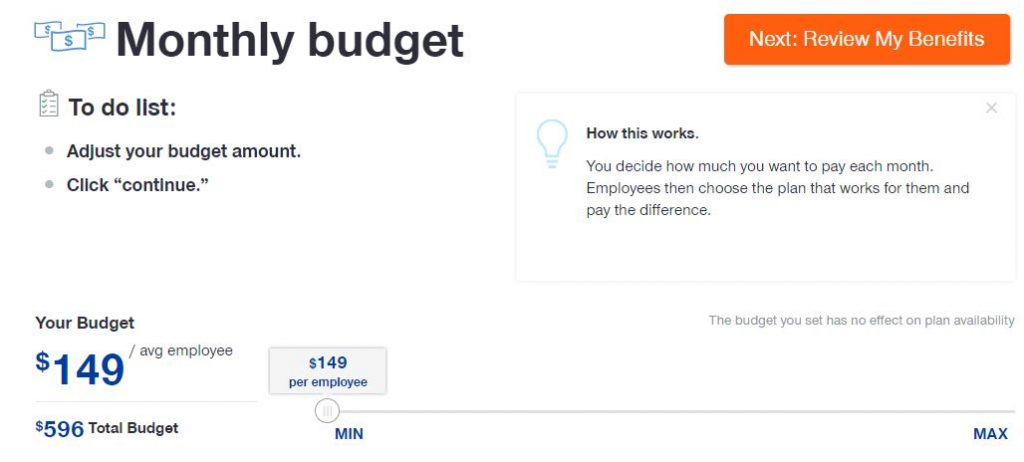

On the following screen, you get to set your monthly budget. You decide how much you want to pay each month. Your employees will select the insurance plan that works for them and they will pay the difference.

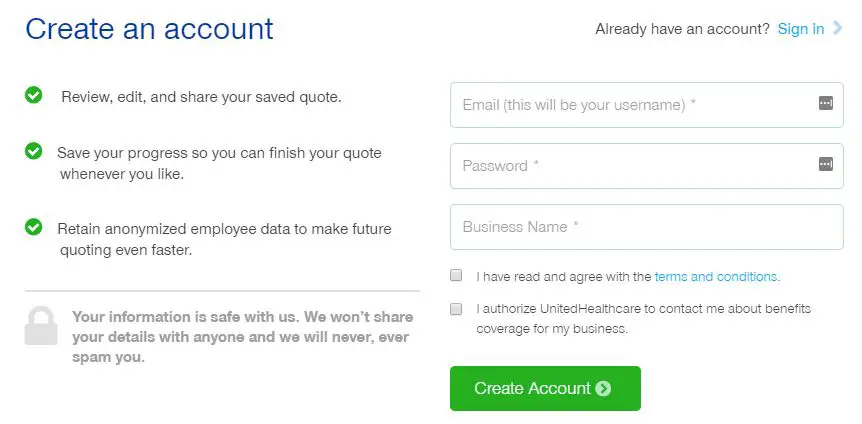

After setting your monthly budget, you will be asked to create an account if you don’t already have one.

There are three parts to the entire process:

- Review the medical plans available for your business. You can select all of the plans or offer only a selection of available plans. There are high, mid and low deductible health insurance options.

- Enter employee details. You can also import employee information from popular apps like Xero, Excel or Quickbooks.

- Set your monthly budget. You set the amount the business will pay and the employee will pay the difference. Employer costs are fixed.

The whole process takes less than 20-minutes. You are guided through an easy to use interface on the UnitedHealthcare website.

Disclaimer: The views expressed do not reflect those of UnitedHealthcare nor its affiliates. They are the personal opinions of the authors. While UnitedHealthcare has made every attempt to ensure accuracy, the information contained in these blogs may change and UnitedHealthcare assumes no responsibility for errors, omissions, contrary interpretations of the subject matter or information herein or for any losses, injuries, or damages arising from its display or use. These blogs may connect to other websites maintained by third parties over whom UnitedHealthcare has no control. UnitedHealthcare makes no representations as to accuracy, completeness, suitability, or validity of any information contained in those linked blogs or third party websites. Blogs are for general informational purposes only and not intended to be medical advice or a substitute for professional health care.