What you need to know:

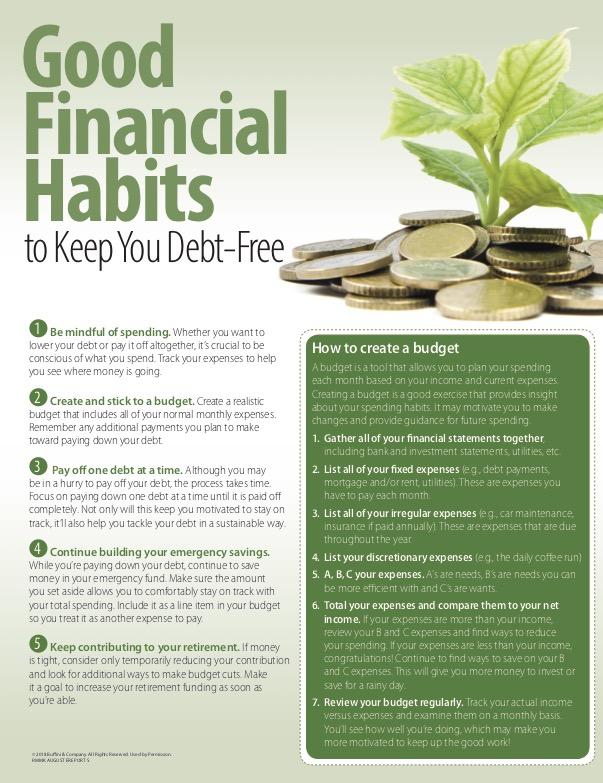

- Better spending starts with discipline

- Keep a budget and stick to it!

- Set a savings goal

- Cut down on unnecessary expenses

Being in debt is no fun at all. The thought of having all these bills to pay and not knowing how you are going to pay them is stressful. We can’t live in this world without money, we need it to survive, which means that spending money is a necessity.

However, excessive spending is not. One of the reasons why people end up in a cycle of debt is because of bad spending habits.

They might pay off one credit card and then end up back where they started because they don’t have the discipline to stop spending. If this sounds like you, here are steps for creating better spending habits while you are in debt.

Stick to a Budget

Sticking to a budget will help you reach your financial goals. Since this is probably something you are not used to, it will take a while to get accustomed to it, but once you do, saving money will become a lot easier. Here are some tips on how to stick to a budget:

- Write it Down: Your first step should be to write down your budget. How much money do you have coming in, and how much money do you need to spend each month? When it comes to creating a budget, your outgoings should not exceed the amount you have coming in every month. To start, only write down the essentials such as rent/mortgage, bills, car note, gas, and food.

- Cut Out Excess: How much money is going out of your account that you don’t need to spend? This might include things like Starbucks coffee, buying lunch, cigarettes, etc. If there is anything on your list of expenses that are not a necessity, cut it out.

- Reduce Your Credit Card Limit: You are more likely to spend money when you know it’s there to spend. When you have a high balance on your credit card, you tend to spend more and pay back less. You can avoid this by reducing your credit card limit and paying off the balance in full each month.

- Budget to Zero: When you are creating a budget, every penny in your account should be allocated. This doesn’t mean you spend every penny, it means that all your funds should have a job. After you’ve paid off your essentials, the rest should go towards paying debts or into a savings account. However, since you are in debt, all your funds should go towards paying that off first before you start saving money.

Look for Bargains

If you need to buy something such as a new washing machine or a dryer. Hunt around for the best deal, you can even shop second hand.

If you are accustomed to expensive brands, downgrade to something cheaper, it won’t be what you are used to but it will save you some additional cash while paying down debt.

Have Patience

When it comes to buying something new, most of us see something and buy it immediately even if it means putting it on a credit card.

Instead of buying things straight away, wait a couple of days and if the urgency wears off, you know you don’t need it. In most cases, you will find that the item is not a necessity.

Stop Shopping While You Wait

A lot of people in debt have a bad habit of shopping while they wait. Whether they are waiting to see a doctor, waiting to collect their child from school, or stuck in traffic. There is a tendency to remember something you need to purchase and hop onto Amazon or any other online store.

One item usually leads to two, then two turns into three, and before you know it, you’ve spent a lot more than you had originally intended. You can avoid this by keeping a magazine or a book with you to help pass the time.

Set a Savings Goal

How much money do you want to save within a certain time? Setting a goal will make the savings process more exciting because you’ve given yourself a target to aim for. Work out how much money you want to save, and how long it will take to save that amount. Your savings goals can be short or long term. For example:

Short Term Goals: A short term savings goal typically takes between 1 to 3 years to achieve. It could be for a vacation, a down payment on a car or an emergency fund.

Long Term Goals: A long-term savings goal typically four years or more to achieve. It could be for retirement, your child’s education, or a down payment on a home. If you have a long-term savings goal such as a child’s education or retirement, save the funds in an investment account such as a 529 plan or an IRA account.[adrotate group=”4″]

Automate Your Savings

As you have probably experienced, saving is easier said than done. You will often find that the minute you decide to start saving, some expense comes up out of the blue. You can avoid falling into the trap of spending the money you hoped to save by automating your payments.

All banks provide this service, all it involves is you deciding how much, when, and where you want the bank to transfer the funds. Make sure that every time you get paid, a portion of that money goes into savings.

Stop Trying to Keep up with The Joneses

One of the biggest mistakes people make is competing with their friends and neighbors. When the neighbor gets a new driveway, you decide that it’s time to get yours done.

When the neighbor gets a new car, you decide it’s time to trade-in for a newer model. Trying to keep up a certain lifestyle and image will keep you stuck in a cycle of spending which will make it very difficult for you to save.

Cut Down on Socializing

It’s good to socialize; however, there is such a thing as too much socializing and we are all guilty of it. There is no need to go to every single social event, go to the most important ones, and say no to the rest.

Explain to your friends that you are not neglecting them but you need to save money and pay off your debts! They will understand and you might even inspire them to do the same.

Instead of going out all the time, you can arrange to have nights in with friends where you watch a movie or play games. This is a great way to socialize and save money at the same time.

Final Thought

Paying off your debt is fantastic; you might even get a side hustle started that brings you in some extra money. But living debt-free isn’t about the amount of money you make, it’s about how much you can save.

If you can’t keep the money you make, you will always be in a perpetual cycle of debt. The aim, therefore, is to develop good saving habits so that once you have got yourself out of debt, you will stay that way.