For small businesses, it is hard to attract and retain top talent without offering a great benefits package. Part of that is a health insurance plan.

Small businesses that offer health insurance benefits give themselves a huge competitive advantage in the marketplace.

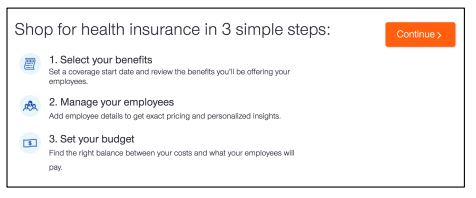

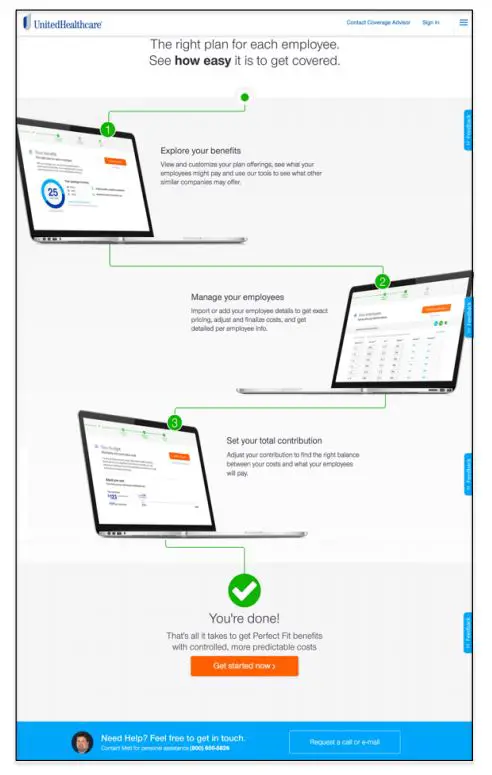

UnitedHealthcare has created a one-of-a-kind online shopping experience that simplifies the process of shopping for health insurance.

Online Shopping Experience

The UnitedHealthcare online shopping experience helps small businesses to:

- Shop for multiple insurance plans.

- Compare multiple plans based on location.

- Receive customized quotes.

- Purchase insurance plans online.

The UnitedHealthcare online insurance shopping experience is unlike anything offered in the insurance industry. It saves time and effort for entrepreneurs, so they can concentrate on growing their businesses.

Offering health insurance will help your small business in several ways:

#1 – Less Expensive Than You Think

Many entrepreneurs have been scared of offering health insurance in fear of enormous costs. Small business entrepreneurs often think that they have to pay for 100% of the benefits. You can offer health insurance and only pay 50% of the costs. (You can pay a higher percentage if the business can afford it.) Your employees will pay the remainder of their premium.

#2 – Competitive Advantage

The competitiveness of your benefits packages greatly influences your ability to hire and retain top talent. Employees consider the benefits you offer before they decide to join your company. The most qualified employees can pick and choose between jobs, and a great health benefits package will increase your chances of attracting the best talent out there. The lack of health insurance can be a deal-breaker when it comes to the decision to join your business.

Many employees will take a lower paying job as long as the company offers a great health insurance package.

#3 – Greater Employee Retention

High employee turnover damages your business’ competitiveness. If you want to build a successful business you have to maintain a high employee retention rate.

Replacing an employee creates additional expenses. You will pay more for recruitment. Your company will also spend more on training and manage new employees. To replace an entry-level employee, you might pay 30-50% of the annual salary. It is even more expensive to replace a mid-level employee which could cost over 150% of the annual salary.

#4 – Healthy Employees Perform Better

If you are not offering health insurance, your employees will only seek medical care in case of emergency. Your employees with no insurance are going to avoid seeking medical help unless it is an emergency. The lack of health insurance makes it more difficult to get medications or vaccinations. The result is that they are more likely to spread illness throughout your company.

When you offer health insurance your staff is much more likely to take advantage of preventative care. They are less likely to get sick. A healthy staff means less sick days and greater productivity.

#5 – Tax Advantage

When you offer health benefits to your employees you can deduct 100% of the insurance costs as a business expense. The owners’ of incorporated companies can also deduct their own health insurance costs.

Make sure that you consult your CPA about the tax benefits of offering health insurance for your employees.

#6 – Benefit Your Family

As an entrepreneur, you can buy a group health insurance plan with as few as one non-related employee. Even if the non-related employee waives the insurance benefit you can still save money with a group health insurance plan. Group plans normally cost less than individual insurance plans.

photo credit: U.S. Fish and Wildlife Service – Midwest Region Banding Ducks at Minnesota Valley National Wildlife Refuge